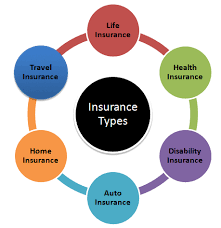

Types of Insurance Policies Explained for Beginners

Insurance can feel overwhelming at first, but at its heart, it’s simply about protection. Different insurance policies are designed to protect you, your family, or your belongings from financial loss. If something unexpected happens, insurance helps cover the costs so you’re not left paying for everything yourself.

Here’s a simple breakdown of the main types of insurance policies, explained in a way that’s easy to understand.

Health Insurance

Health insurance covers medical expenses like doctor visits, hospital stays, surgeries, and medications. Instead of paying the full bill yourself, your insurance company helps cover the costs.

For example, if you break your arm, health insurance helps pay for the X-rays, hospital treatment, and follow-up visits. Without it, you’d have to pay the full bill on your own, which can be very expensive.

Life Insurance

Life insurance is designed to protect your loved ones financially after you pass away. When you die, the insurance company pays a lump sum of money (called the death benefit) to the person you choose, like your spouse or children.

This money can help cover living expenses, pay off debts, or even secure your family’s future education or lifestyle.

Auto Insurance

Auto (or car) insurance protects you financially if you get into a car accident. It can cover the cost of repairing your car, damage to someone else’s car, medical bills from injuries, and even lawsuits if you’re found at fault.

In many countries, having car insurance isn’t optional—it’s required by law before you can drive.

Homeowners or Renters Insurance

If you own a home, homeowners insurance protects your house and belongings against risks like fire, theft, or natural disasters. It can also cover accidents that happen on your property, like if someone slips and gets hurt.

If you rent, renters insurance protects your personal belongings inside your rented apartment or house. For example, if a pipe bursts and damages your furniture, renters insurance can help replace it.

Travel Insurance

Travel insurance is useful when you’re going on a trip. It can cover costs if your flight is canceled, if you lose your luggage, or if you need medical care while abroad. It gives peace of mind when you’re far from home.

Business Insurance

If you own a business, this type of insurance protects you from losses related to your work. It could cover things like damage to your office, lawsuits from clients, or even help if your business is forced to temporarily close.

Other Specialized Insurance Policies

Apart from the main types above, there are more specific policies depending on your needs, such as:

- Pet Insurance – covers vet bills for your furry friends.

- Disability Insurance – provides income if you can’t work due to illness or injury.

- Critical Illness Insurance – pays out a lump sum if you’re diagnosed with a serious illness like cancer or a heart attack.

A Quick Way to Remember

- Health insurance = Protects your health.

- Life insurance = Protects your family’s future.

- Auto insurance = Protects you and your car.

- Home/Renters insurance = Protects your home and belongings.

- Travel insurance = Protects your trip.

- Business insurance = Protects your company.

Insurance is simply about being prepared for life’s “what ifs.” Different policies serve different purposes, and the right mix depends on your stage of life and personal situation. For beginners, the most common policies to consider are health, life, auto, and home/renters insurance. Once you’re comfortable, you can explore specialized coverage depending on your lifestyle and needs.